which states have a renters tax credit

Their reductions are tax credits -- not tax deductions. It is a program for low-income people age 58 or older who rent their home.

2021 State Tax Credit Information Please note this content refers to to state low-income housing tax credit programs - not the federal LIHTC program.

. If the dwelling that is rented is owned by a tax exempt charitable organization or is exempt in any way from property taxation a tax credit cannot be granted. Oregon has Elderly Rental Assistance ERA program it is not really a credit though. 43533 or less if your filing status is single or marriedregistered domestic partner RDP filing separately.

In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. Its a massive disparity Glazer said. The following chart is intended for summary purposes only.

Officers of the state county or municipality in their. Generally tax credits lead to larger reductions than individual tax deductions. The renters credit adds up to just 160 million according to the states Franchise Tax Board.

You paid rent in California for at least 12 the year. In 2019 the Department will be accepting applications through October 1. Renters Tax Credit Application Form RTC 2019 The State of Maryland provides a direct check payment of up to 100000 a year for renters who paid rent in the State of Maryland and who meet certain eligibility requirements.

If youve lived in California for at least half of the year youre potentially eligible for a renters tax. STATE RENTERS CREDITS Renters tax credits can be instituted at the state as well as the federal levels. Renters A renter may qualify for a refund of a portion of the.

Michigan renters are eligible to receive state income tax reductions on the rental fees they paid during the year to their landlords. The New York City enhanced real property tax credit can get renters a credit of up to 500 if they made less than 200000. That being said each state has its own unique set of rules and we get into these specifics below.

The property was not tax exempt. As far as I know the states that have anything for rent are Vermont Michigan MaineMaryland Massachusetts Minnesota Missouri New Jersey. Their total household income for 2020 was 16200 and paid 50000 per month in rent.

The applicant must have a bona fide leasehold interest in the property and be legally responsible for the rent. Some of the. Most of these credits are provided as part of a circuit breaker tax credit designed to provide relief from property tax burdens circuit.

More than 20 states provide tax credits to help renters afford housing. A national cap of 5 billion would allow states to use the Renters Credit to assist about 12 million families. In California renters who make less than a certain amount currently 41641 for single filers and 83282 for married filers may be eligible for a.

87066 or less if you are marriedRDP filing jointly head of household or. If you request an RPA by email only include the last four digits of Social Security Numbers. As state LIHTC programs vary widely we recommend that you gather complete details from the appropriate state agency.

ERA is based on income assets and the amount of rent fuel and utilities paid. STATE RENTERS CREDITS Renters tax credits can be instituted at the state as well as the federal level. The renters tax credit was established in 1972 and has increased just once in 1979.

George and Robin Smith ages 34 and 33 have two dependents under the age of eighteen 18. California homeowners receive more than 9 billion in property tax capital gains and mortgage interest deductions. Review the credits below to see what you may be able to deduct from the tax you owe.

As far as I know the states that have anything for rent are Vermont Michigan MaineMaryland Massachusetts Minnesota Missouri New Jersey Rhode Island California Hawaii Indiana Iowa Arizona Wisconsin and Connecticut. Likewise people ask what states offer renters credit. Tenants in Hawaii who pay at least 1000 in rent and make less than 30000 a.

Your California income was. Follow the instructions on the RPA when applying for your Renters Property Tax Refund. And Representative Barbara Lee D-CA included a renters credit in the Pathways Out of Poverty Act she introduced in 2014 and again in 2015.

The state will determine your eligibility using the formula comparing rent and gross income. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. The rented property must be subject to property tax.

Qualified Michigan renters can take advantage of the states homestead tax credit typically available to only homeowners in. All of the following must apply. Renters tax credit based on income California.

More than 20 states. Where do I get a renters credit tax return. Oregon does not have renters credit.

Since then median rent in the state has more than quintupled according to Glazers office. Glazer says the bill is about making the tax code fairer for renters. If your state has anything for renters you will be prompted to enter your rent info when you complete your state return.

You are only eligible to receive a tax credit for rent paid in the State of Maryland. There is not a rent deduction or credit on your Federal return. As with LIHTC each states share of the credits would be set using a per-capita formula with a minimum allocation for small states.

The New York City enhanced real property tax credit can get renters a credit of up to 500 if they made less than 200000. D-NY introduced the Renters Tax Credit Act in 2014. As far as I know the states that have anything for rent are Vermont Michigan MaineMaryland Massachusetts Minnesota Missouri New Jersey.

Click to see full answer.

Rent Receipt Free Printable Www Rc123 Com Free Receipt Template Receipt Template Being A Landlord

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

Pin By Liam Homes On Real Estate Atlanta Forrent Com Rental Real Estate Investing Rental Property

How Artwork Can Become A Tax Write Off Income Tax Return Income Tax Tax Services

Where S My Refund How To Track Your Tax Refund 2022 Money

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Tax Advantages Of Owning A Home Tax Deductions Tax Deductions List Tax Refund

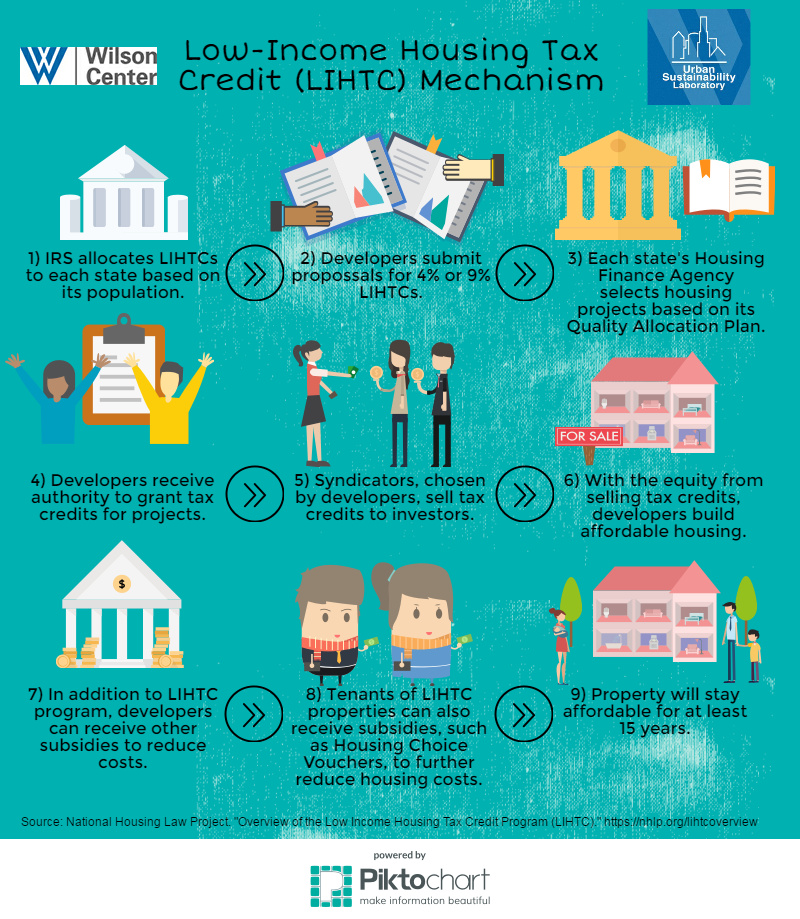

Infographic The Low Income Housing Tax Credit Program How Does It Work Wilson Center

Did You Know There Are Tax Deductions For Volunteer Work Tax Deductions Tax Help Deduction

Checklist To Help You Avoid Mistakes On Your Taxes Tax Queen Tax Checklist Small Business Tax Tax Time

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

The History Of Taxes In America Taxslayer Income Tax Us Tax

Pin On Best Of Savvy Family Finance

Maryland Renters May Qualify For 1 000 Payment And You Have To Ask For It Wbff In 2022 Saving Money How To Get Rich Money

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Best Practices For Renting To Students Some Tips On Creating A Real Estate Investing Rental Property Rental Property Investment Rental Property Management