what is the percentage of taxes taken out of a paycheck in colorado

Also divided up so that both employer and employee each pay 145. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS.

New Tax Law Take Home Pay Calculator For 75 000 Salary

Where Do Americans Get Their Financial Advice.

. As an employer youre paying 6 of the first 7000 of each employees taxable income. Supports hourly salary income and multiple pay frequencies. This free easy to use payroll calculator will calculate your take home pay.

However they dont include all taxes related to payroll. Colorado Salary Paycheck Calculator. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

Amount taken out of an average biweekly paycheck. You Should Never Say I Cant Afford That. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding. These amounts are paid by both employees and employers. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator.

There is no wage base limit for Medicare. If you increase your contributions your paychecks will get smaller. FICA taxes are commonly called the payroll tax.

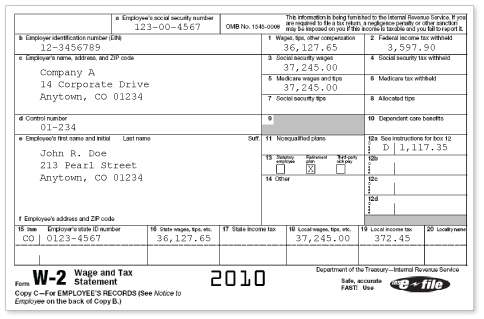

Employers are required to file returns and remit tax on a quarterly monthly or weekly basis depending on the employers total annual Colorado wage withholding liability. Every employer must prepare a W-2 for. Overview of Colorado Taxes Gross Paycheck 3146 Federal Income 1418 446 State Income 509 160 Local Income 350 110 FICA and State Insurance Taxes 780 246.

Census Bureau Number of cities that have local income taxes. The Colorado bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The good news is that If you pay your state unemployment taxes in full and on time each quarter you can claim a tax credit of up to 54.

You pay the tax on only the first 147000 of your earnings in 2022. For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount. For 2022 employees will pay 62 in Social Security on the first 147000 of wages.

Everything You Need To Know About Taxes This Year Rich Dad Poor Dad Author Robert Kiyosaki. Amount taken out of an average biweekly paycheck. Both employee and employer shares in paying these taxes each paying 765.

FICA taxes consist of Social Security and Medicare taxes. These amounts are paid by both employees and employers. Both employers and employees are responsible for payroll taxes.

Switch to Colorado hourly calculator. The more you claim the less they take out of. Any income exceeding that amount will not be taxed.

Colorado income tax rate. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Total income taxes paid. Your employees get to sit this one out so dont withhold FUTA from their paychecks. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. It is not a substitute for the advice of an accountant or other tax professional. The percentage rate for the medicare tax is 145 percent although congress can change it.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. How much taxes are taken out of a 1000 check. Amount taken out of an average biweekly paycheck.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. For self-employed individuals they have to pay the full percentage themselves. The Colorado bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

However an extra 9 must be withheld for employees making in excess of 200000 per year the employer does not share this extra tax it is paid only be the employee. Youll pay 1830 plus 12 percent on that amount which works out to 7750. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Colorado residents only.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Colorado Paycheck Quick Facts.

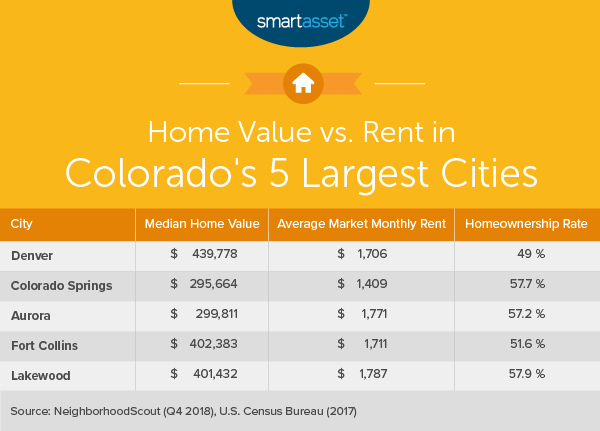

The Cost Of Living In Colorado Smartasset

State W 4 Form Detailed Withholding Forms By State Chart

Healthcare Management Salary In Colorado Springs Co Comparably

2022 Federal State Payroll Tax Rates For Employers

Colorado Paycheck Calculator Adp

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How Much Tax Is Taken Out Of My Paycheck In New Brunswick Cubetoronto Com

Colorado Paycheck Calculator Smartasset

Colorado Paycheck Calculator Smartasset

Individual Income Tax Colorado General Assembly

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

What Percentage Of Taxes Are Taken Out Of Paycheck In Nova Scotia Cubetoronto Com

Individual Income Tax Colorado General Assembly

Here S How Much Money You Take Home From A 75 000 Salary

7 Paycheck Laws Your Boss Could Be Breaking Fortune

Individual Income Tax Colorado General Assembly

Math You 5 4 Social Security Payroll Taxes Page 240

Colorado Paycheck Calculator Adp

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp