take home pay calculator madison wi

Well do the math for youall you need to do is enter the applicable information on salary federal and state. The tax rates which range from 354 to 765 are dependent on income level and filing status.

Pink Door Your Text Moving Announcements Moving Announcements Pink Door The Stationery Studio

Use ADPs Wisconsin Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

. The calculator on this page is provided through the ADP. Living Wage Calculation for Wisconsin. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

Chula Vista Two Bedroom Condos Wisconsin Dells Condo Rentals Chula Vista Resort Wisconsin Dells Wisconsin Dells Waterpark Park Resorts. 474 rows How much do you make after taxes in Wisconsin. If youre eligible for a 10000 bonus you might only come away with just over 6000 of it once taxes are applied.

23 rows Living Wage Calculation for Madison WI. Calculate your Wisconsin net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Wisconsin paycheck calculator. The living wage shown is the hourly rate.

View future changes in the minimum wage in your location by visiting Minimum Wage Values in. This calculator is intended for use by US. Calculate your take home pay from hourly wage or salary.

The Wisconsin Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Wisconsin State Income Tax Rates and Thresholds in 2022. If youre eligible for a 10000 bonus you might only come away with just over 6000 of. This Wisconsin hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Switch to Wisconsin hourly calculator. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Demands for a living wage that is fair to workers have resulted in numerous location-based changes to minimum wage levels.

Take home pay calculator madison wi. We issue a wage attachment for 25 of gross earnings per pay period. Wisconsin state income tax is a graduated tax which means that the percentage of tax owed increases as income increases.

Sample Car Loan Amortization Schedule Template Car loan. There are also a number of deductions and credits. Details of the personal income tax rates used in the 2022 Wisconsin State Calculator are published below the.

Take home pay is calculated based on up to six different hourly pay rates. The first 11770 of taxable income is taxed at 4 the next 23540 is taxed at 584 the next 47080 is taxed at 765 and any income over 77640 is taxed at 897. Note that bonuses that exceed 1 million are subject to an even higher rate of 396 Now 25 may not seem like all that much but if.

Use our take home pay calculator to determine your after-tax income by entering your gross pay and additional details. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Wisconsin. The assumption is the sole provider is working full-time 2080 hours per year.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Wisconsin. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. The process is simpler than you think.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Wisconsin. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Important note on the salary paycheck calculator. Wisconsin Salary Paycheck Calculator. Bonuses are considered supplemental wages and as such are subject to a different method of taxation.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Take home pay calculator madison wi.

The most typical earning is 52000 USDAll data are based on 292 salary surveys. The federal minimum wage is 725 per hour while Wisconsins state law sets the minimum wage rate at 725 per hour in 2022. Most employers tax bonuses via the flat tax method where an automatic 25 tax is applied to your payment.

Switch to Wisconsin salary calculator. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. It can also be used to help fill steps 3 and 4 of a W-4 form.

This Is One Of Our Properties That Has Apartments For Rent In Madison Wi Beautiful Property Glacier Valley Apartments For Rent House Styles Apartment

Wisconsin Income Tax Calculator Smartasset

Human Ecology The Weiler Ladies Tailor Dressmaker Designer Cutter And Fitter Book How To Use The Weiler Block Human Ecology Dressmaking Uw Madison

Pink Pastel App Icons Bundle 600 Aesthetic Custom Themed App Icons Pastel Pink Ios Icons Pastel Icons Iphone Wallpapers Widgets

Financial Comps Best In Show Consulting

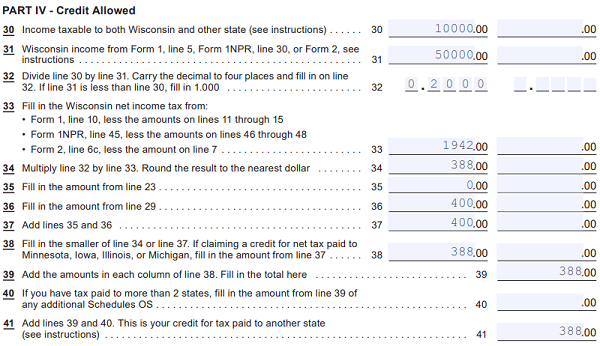

Dor Pass Through Entity Level Tax Partnership Partner Reporting Questions

Point Place Apartments Madison Wi Apartments Com

Regency House 55 Older Apartments Manitowoc Wi Apartments Com

1914 Vilas Ave Madison Wi 53711 Realtor Com

Illinois No Money Down Mortgage First Time Home Buyers Home Loans Home Improvement Loans

Wisconsin Income Tax Calculator Smartasset

Ergonomic Office Desk Chair And Keyboard Height Calculator

Wisconsin Income Tax Calculator Smartasset

Wisconsin Mortgage Calculator Fast Easy Find Low Wi Rates Mortgage Payment Mortgage Calculator

Milo Milo Appleton Resale Appleton Linwood Milo Furniture

Outdoor Decor Somatic Cell Outdoor

How Competitive Is University Of San Diego S Admissions Process