rhode island tax table 2020

Rhode Island Single Tax Brackets. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table.

Rhode Island Department Of Human Services Facebook

If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet.

. 2020 Rhode Island State Tax Tables. 2020 Due Date. There are -810 days left until Tax Day on April 16th 2020.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Includes All Towns including Providence Warwick and Westerly. The Rhode Island Single filing status tax brackets are shown in the table below.

Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. 1040MU 2020 Credit for Taxes Paid to Other State multiple PDF file less than 1mb. PPP loan forgiveness - forms FAQs guidance.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. The Rhode Island State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Rhode Island State Tax CalculatorWe also. 1 Rates support fiscal year 2020 for East Providence.

More about the Rhode Island Tax Tables. The tables on pages 6 and 7 of this booklet should be used. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing.

Find your pretax deductions including 401K flexible account. NEW FOR 2020 - IF YOU AND ALL MEMBERS OF. Rhode Islands income tax brackets were last changed.

Details on how to. Rhode Islands tax brackets are indexed for. This form is for income earned in tax year.

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. 2 Municipality had a revaluation or statistical update effective 123119.

Find your income exemptions. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. 2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes Easily.

Rhode Island State Income Tax Forms for Tax Year 2021 Jan. 3 West Greenwich - Vacant land taxed at. The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode.

Rhode Island Income Tax Forms. Download or print the 2021 Rhode Island Tax Tables Income Tax Tables for FREE from the Rhode Island Division of Taxation. Masks are required when visiting Divisions office.

Latest Tax News. 2020 RHODE ISLAND EMPLOYERS INCOME TAX WITHHOLDING TABLES wwwtaxrigov. Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009.

2022 Filing Season FAQs - February 1 2022.

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

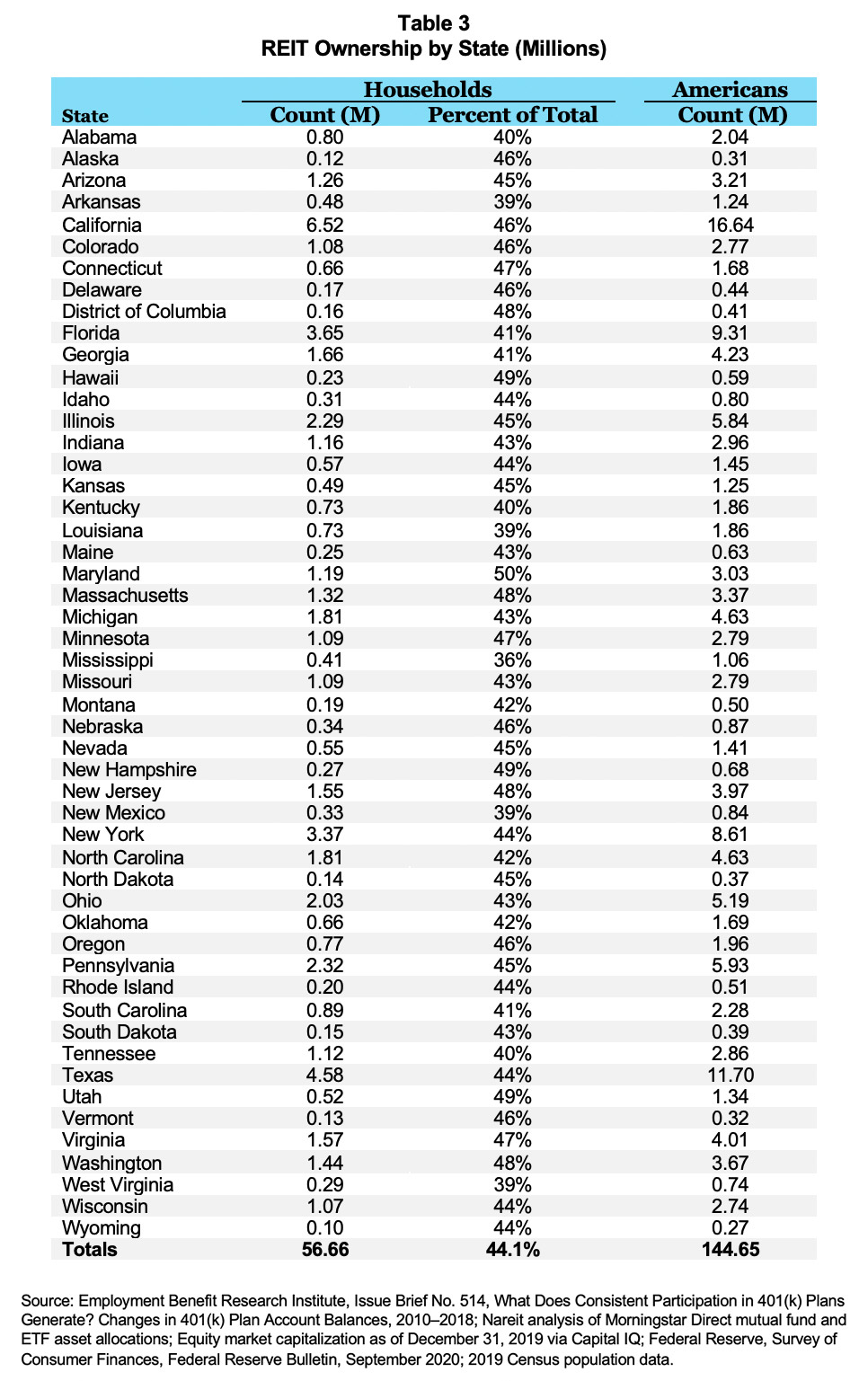

145 Million Americans Own Reit Stocks Nareit

Rhode Island Coronavirus Map And Case Count The New York Times

Sales Tax On Grocery Items Taxjar

Rhode Island Coronavirus Map And Case Count The New York Times

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Sba On Twitter Question 3 There Are Many Different Types Of Business Structures How Do You Determine Which One Is Right For You Sbachat Twitter

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Tax Burden By State 2022 State And Local Taxes Tax Foundation